Debts play a prominent role in crime novels.

Someone owes someone else money, and if they don’t pay it back on time…well, you know what happens. A threat. A beating. A body part removed. And then—

As readers, we understand the lengths the debtor will go to either avoid the punishment or to make the debt right. Beg, borrow, plead, bargain, steal.

We can relate because we’ve all had debts to pay. It’s the American way of life. Hell, the government owes over thirty trillion dollars. That’s more than 91k for each citizen in the country.

Not to mention mortgages, car payments, credit cards.

Student loans.

Yup, I went there. I said it.

Student frickin’ loans.

Twenty-five percent of Americans currently have student loan debt. Obviously, many more have had it in the past and paid it off. Including me. I’m not sure anything in my life has ever made me as angry, sad, frustrated, and tangled up inside as my student loan debt. Living with that loan was like living with a gas leak. I couldn’t see it. I could pretend like it wasn’t there much of the time.

But if affected me. As much as I tried to kid myself, it subtly colored every thought I had, every plan I made.

I worried it would get so big I’d never pay it back, that metaphorically it would eventually explode and render me emotionally and financially bankrupt.

I’ve written books about characters who have killed for all sorts of reasons—infidelity, sex, money, jealousy, sibling rivalry.

I know a little bit about some of those things, either from observation, anecdote, or direct experience. But none of them ever drove me to commit a crime.

But my student loan on the other hand….hmmm…

It started promisingly enough. I wanted to go to college, and my dad—not the best money manager in the world—assured me, “You can go to school wherever you want. We’ll find a way to pay for it.”

I chose Indiana University, a great school. Also, inconveniently located across the state line from where I lived. Which meant it cost more money. Twice as much money.

“No problem,” said Dad. “When you get there, just go to the financial aid office and sign some forms.”

So I did what he said. I signed and I signed. Every year, I went and signed. I’ll step in here to say I knew I was taking out a student loan. I knew there was a financial aid package that involved a Pell Grant and work study as well. (I worked as a janitor, sweeping out the room where they stored cadavers for the anatomy lab. And you wonder why I write books about dead people?)

My name was on the forms, my signature. I knew what was happening. But I didn’t really understand money back then.

Wait, let me be more accurate—I didn’t understand interest.

Some of us are old enough to remember the Faberge shampoo commercial from the 80s in which a woman extols the virtues of the product and decides to tell a friend. And then her friend tells a friend. Until the screen fills with the faces of hundreds of happy women who are now absolutely thrilled to be using Faberge shampoo.

I knew that commercial well because it played all the time. I just didn’t know that was also how interest worked. When I graduated from college, I owed about fourteen thousand dollars. My first job was as a waiter. I don’t think I quite earned fourteen thousand dollars that first year. Or any of the next few.

No one at the loan company really seemed that bothered when I didn’t make my payments. They gave me relief if I asked for it. Months and even years off from making a monthly payment.

But that interest? It told two dollars. And they told two dollars. And so on and so on.

It took me almost twenty years to pay the loan off. I don’t want to think about or know how much I spent in total. It’s too painful to consider.

For a long time, I fantasized about paying the loan off. I imagined great joy. A celebration. Champagne, cigars, a giant meal.

But in the end, I felt nothing when I transferred the funds to them. Not joy. Not even relief. It was just a task crossed off my list. Like paying the electric bill. It was over and done. At long last. Like a merciful death after a long illness.

And I’m one of the lucky ones who could pay and move on with my life.

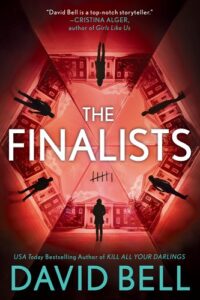

My new book, The Finalists, is about a small private college bankrolled by a wealthy donor. Every year that donor awards a lucrative scholarship, one that provides tuition, a job after graduation, and loan forgiveness up to 100k. All the students have to do is agree to be locked in a creepy old house on the edge of campus for eight hours. Things get complicated pretty quickly inside that locked house because one student drops dead. And the others realize one of them is the killer.

To me, it seemed simple. If someone had offered me the chance to get out from under my student loan debt, and all I had to do was agree to be locked in a house for eight hours, I’d do it without a thought.

I teach at a public university in Kentucky. I have students who work two jobs. I have students who sell their plasma. I have students who sell their sperm, their eggs. I have students who suffer food insecurity and skip going to the doctor in order to pay for school.

Eight hours in a rickety house with a killer? No sweat.

If I’d had a crystal ball in college and could clearly see the twenty years of multiplying interest payments that stretched ahead of me, I would have begged a rich old eccentric to invite me into his house.

But some people said they found that concept hard to believe. Why would anyone agree to do this?

If you don’t know, then you’ve clearly never had student loan debt. A multiplying, expanding black hole of debt that follows you around for the rest of your life.

The kind that makes you wonder how far you’ll go to finally be free of it.

***