Here’s how the story of America’s Great Diamond Hoax—“one of the most remarkable swindles ever perpetrated,” to quote a newspaper of the era—usually begins. In November 1870, a couple of grimy, malodorous men pounded on the San Francisco office door of George D. Roberts, a mine broker and speculator known for his kind-heartedness but also for a “shady past” well littered with abortive bonanza stratagems. Although Roberts had previously shut down for the evening, he was waiting for these two, so welcomed them in off the wooden sidewalk.

Roberts was better acquainted with the younger, more handsome member of that duo: Philip Arnold, a robust, self-sufficient, and smooth-talking Kentucky native, about 41 years old, who’d served in the Mexican–American War before joining the mid-19th-century rush to find gold in California. He later worked on gold- and silver-mining operations in which Roberts held investments. Beside Arnold stood his elder, taciturn prospector cousin, John Burcham Slack. The visitors appeared nervous, “coy and cautious,” by one account. They carried with them a buckskin bag, which they intimated held something of significant worth. They wouldn’t say exactly where or how they had acquired their riches, or precisely what the sack contained, but they did let slip—with feigned reluctance—a vague mention of rough diamonds. Arnold explained how they had hoped to deposit their poke at the Bank of California, a stately pile at California and Sansome streets, but had arrived there after opening hours. Would Roberts, they asked, mind storing their valuables in his office safe until the morning? The businessman agreed, handing his visitors a receipt for their goods and promising not to peek into the bag or mention its existence to others.

Of course, Arnold—a canny judge of human behavior—was betting on Roberts being both inquisitive enough and rapacious enough to break that pledge. Which he did upon the cousins’ exit into the night, beholding inside their pouch dozens of uncut garnets, sapphires, emeralds, rubies, and most importantly, diamonds. In short order, Roberts sought an audience with Bank of California mastermind William Chapman Ralston. An Ohio-born capitalist brimming with energy, grand ambition, and the splendid madness of optimism, Ralston had settled in the Bay Area in 1854 and begun transforming San Francisco into one of the world’s corporate and cultural capitals. He constructed factories, sank money into sugar refineries and his city’s major water-supply company, raised an opulent theater, and gained considerable control over Nevada’s Comstock Lode of silver ore. Roberts figured that if anyone could recognize the potential for diamond-mining, and exploit that potential to the fullest, it would be this oft-called Magician of San Francisco.

Consulting a range of sources turns up contradictions and raises questions about this neat little narrative. Did John Slack really accompany Arnold to Roberts’ office, or was it somebody else? Did the cousins bare their stones to Roberts right off the bat, rather than leaving him to uncover them on the sly? Did they even approach the mine broker first, or did they go directly to Ralston’s bank with their bounty, allowing a teller there to apprise his boss of their ostensibly excavated assets? And did all of this occur near the end of 1870, or instead months into the next year?

History can be damnably imprecise when it comes to facts.

One thing is certain, however: With their hints of a treasure trove to be plundered somewhere in the vast, open wilds of the West, Arnold and Slack unleashed an avaricious frenzy that ultimately found deep-pocketed shareholders in a mining venture expecting to extract a million dollars each month from the diamond fields. Before the scheme’s spectacular debunking—in November 1872, 150 years ago—the flimflammers had suckered not only Ralston, but a galaxy of notables, among them an eminent newspaper editor, an erstwhile Union Army commander and presidential candidate, and the nation’s foremost jeweler. To think, an early observer of Arnold and Slack dismissed them as “simple-minded fellows.” Hah!

* * *

Thanks to westward migration resulting from the region’s successive gold and silver booms, by 1870 San Francisco was California’s largest city, boasting a population of more than 149,000—nine times as many people as lived in Sacramento, the capital, and more than 25 times the residency of Los Angeles. It became known for great wealth as well as great wickedness. Ostentatious mansions—particularly those erected by transcontinental-railroad barons and silver kings—bristled atop Nob Hill, while just to the east, dance-halls and gambling parlors, bawdy houses, opium dens, and a superfluity of watering holes vied for customers in the rowdy, ribald Barbary Coast district. San Francisco attracted more than its fair ration of eccentric characters, such as Joshua Norton, an English merchant who, after losing a fortune—and perhaps his sanity, to boot—re-created himself as Norton I, Emperor of the United States and Protector of Mexico. It also drew card sharps, shanghaiing ruffians, pitiless killers, intrepid street thieves…and confidence men.

Prior to the diamond scam, Philip Arnold (shown on the left) wasn’t notorious for hucksterish inclinations. A fast learner and a family man, he enjoyed a reputation as a conscientious, reliable mine employee, his integrity not seriously questioned. What led him to try his hand at crime is unclear. Maybe he simply got tired of seeing so many other people grow affluent in his orbit, as he plodded along, and he fancied this hustle was his main chance, no matter its improbability.

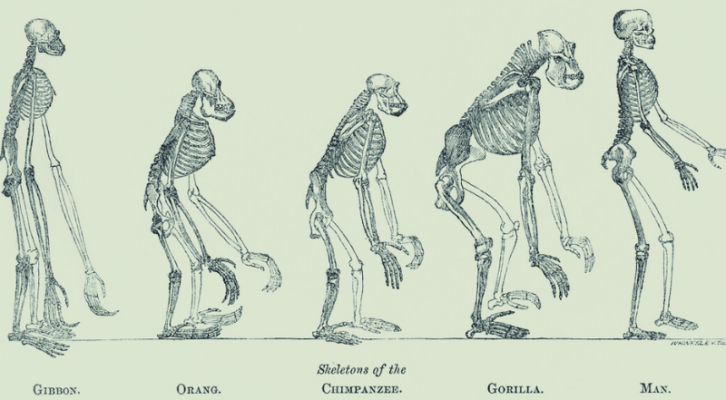

The roots of Arnold’s bunco game can likely be traced to a job he took as a bookkeeper for a diamond drill company in San Francisco, between mining gigs. The flawed and discolored, industrial-grade diamonds used in manufacturing drill bits weren’t so very precious, but they nonetheless drew Arnold’s notice. He began studying the nuances of gem quality, the geological processes (extreme heat and pressure) that led to carbon being formed into diamond crystals, and the sorts of environments in which such stones might be discovered. “By the spring of 1871,” A.J. Liebling related in a 1940 New Yorker article about the Great Diamond Hoax, Arnold “knew as much about diamonds as anybody on the coast.” Equally important, he realized who didn’t know about rough diamonds—and that included San Francisco’s self-aggrandizing nabobs.

Arnold was doubtless aware that top-quality Golconda diamonds had been mined in India for 2,000 years. Not until the 18th century did Brazilian rivers become another source of such jewels, and South Africa emerged as an even bigger player in the diamond market in the 1870s. Despite tall tales spread by western mountain men of their having plucked random gems from the ground, and news that smatterings of diamonds were incidentally unearthed in California during the gold stampede, no substantial caches had been revealed in North America. Yet with the West already having given up impressive quantities of other much-sought minerals, the odds seemed favorable that more lucrative bounties awaited the taking. As journalist and author Herbert Asbury wrote in The American Mercury in 1932, “No man of authority would have been brash enough to say dogmatically that there were no diamond fields in the United States.” Philip Arnold understood how bewitching the mere prospect of serendipitous prosperity could be, and he intended to turn greed to his advantage.

At least some of the earth-stained stones he left in George Roberts’ safekeeping may have been obtained via the drill-bit outfit he had worked for; others could have come from the Arizona Territory, where he and John Slack had engaged in prospecting, and where Native Americans were known to trade sparkly rocks for other goods. Whatever their origin, they surely ignited a gleam in banker Ralston’s eye.

The day after Arnold and Slack’s evening meeting with Roberts, the pair were summoned to Ralston’s elegant office. He apologized for Roberts having violated the sanctity of their sack, and sharing its thrilling secret with him. He went on to inquire as casually as possible where the cousins might have come by their astonishing prize, which a jeweler had allegedly reckoned to be worth $125,000 (many times the stones’ true value). Arnold was stingy with useful information, neither confirming nor denying talk of those gemstones having been retrieved from “Indian Country,” maybe Arizona or neighboring New Mexico Territory. He was still less disposed to entertain suggestions that they sell the controlling interest in their strike to Ralston and other investors he could muster. However—and this is where the first hook in this fine fraud was firmly set—the hitherto tight-lipped John Slack allowed that he wasn’t completely averse to swapping his stake for cash.

Now, Ralston (right) hadn’t achieved the pinnacle of San Francisco’s financial hierarchy by acting impetuously or without proof that whenever he sank his own funds, or his bank’s resources, into a commercial enterprise, it was a sound move. So he told Slack and Arnold that he wouldn’t give either of them a dime until an agent of his choosing verified their lucky strike’s actuality. (Some sources insist the demand was for two representatives.) He entrusted said assignment to David Douty Colton, a one-time county sheriff and aspiring lawmaker, who would go on to become a director of the powerful Central Pacific Railroad and build one of Nob Hill’s original deluxe abodes. The sharpers agreed to lead Colton to their hoard—but only if his eyes were covered on the way.

With those arrangements made, Arnold, Slack, and Colton soon boarded an eastbound train at Oakland, California, and headed…well, Colton knew not where. They disembarked their coach and then spent four days on horseback crossing desolate countryside in order to reach their destination, a circuitous journey that left Colton exhausted and confused. Yet when his blindfold was at last removed, what he found on the sandy tract where they’d stopped perked him up immediately. Namely, raw diamonds, rubies, and other coveted gems. He fairly cavorted about the tableland, barely searching or digging at all to expose what appeared to be a king’s ransom. Only Arnold’s warning that he had spied what might be hostile Indians nearby halted Colton’s stuffing his pockets, and got him back in the saddle, pointed homeward.

“The party returned,” according to a later record, “with the most rose-colored reports of the genuineness of the properties and their fabulous richness. It was this report that set Ralston and his associates wild.”

There was only one problem: that diamond deposit was anything but genuine. It was a conspicuous forgery of nature meant to fool investigators like Colton, who were too naïve to know that the various stones located there couldn’t possibly exist within the same geological matrix. As a prime element of their subterfuge, Arnold and Slack had “salted” that middle-of-nowhere plot with more uncut gems from their supply. Getting Colton away from the spot ahead of his realizing its treasures were limited in scope and abundance was essential to their plans for bilking the barons of San Francisco.

* * *

It’s said that Colton, Arnold, and Slack brought to the Bay Area 60 pounds of stones, which—though they weren’t assessed as of premier quality—suggested there were more, and probably more profitable, pickings to be reaped. On that basis, Ralston agreed to pay Slack $100,000 for his portion of the claim, but only half of it upfront. He and Arnold (who continued to resist bids to relinquish his own rights to the purported riches) would have to fetch many more diamonds from their field—a good-faith gesture—before the balance would be paid.

Estimating that several million dollars were needed to get a proper gem-mining operation up and running, Ralston set about enlisting support from select investors. He convinced General George S. Dodge, a Union Army veteran turned mining capitalist, and William M. Lent, who’d helped bankroll Comstock Lode development, to become involved with this project. As George Roberts had been integral to the gamble from its outset, he was likewise admitted into the fold. Finally, Ralston cabled an invitation to Asbury Harpending, a colleague and friend who was in London, England, flogging Nevada mining securities. Harpending was a colorful figure. Like Arnold and Slack, he hailed from Kentucky, but had left to seek success in mining out West. Early in the Civil War, Harpending, a Southern sympathizer, had participated in failed conspiracies to sever California and Oregon from the Union and to raid ships transporting gold and silver out of San Francisco as a means of subsidizing the rebel cause. (“It would have been hard to find a more reckless secessionist than myself,” he avowed in a largely self-inflating 1913 autobiography.) For his misdeeds, Harpending was convicted of high treason and sentenced to a decade’s incarceration, but was subsequently freed as part of an amnesty for political prisoners.

By the time Ralston contacted him regarding a prospective diamond rush, Harpending (left) had principally restored his standing, his business fingers deep into mining and real estate concerns. Ralston admired his friend’s perspicacity and daring, and dearly wanted him at his side when founding America’s first diamond mine company. His cablegram to Harpending was so verbose, so enthusiastic, that it cost him $1,100 just to send! It also caused its recipient to fret that the Magician of San Francisco “was laboring under some strange delusion.” Yet British banker and politician Baron Rothschild, to whom Harpending showed that lengthy dispatch, advised him to “not be so sure of that. America is a very large country,” remarked the peer. “It has furnished the world with many surprises already. Perhaps it may have others in store.” Harpending needed no stronger prod to make him book passage west for California.

Meanwhile, Arnold and Slack were hastening in the opposite direction. Having now depleted their reservoir of gems, in the spring of 1871 they set off for London with the aim of procuring more. They took a roundabout train route east to obscure their intentions, and eventually sailed from Halifax, Nova Scotia. Once in London, the con men adopted aliases—Arnold recasting himself as “Mr. Aundle,” and Slack repurposing his middle name to become “Mr. Burcham”—before seeking out a respected diamond merchant, one Leopold Keller. As Smithsonian magazine explained in a 2004 piece, “they bought $20,000 worth of rough diamonds and rubies, thousands of stones in all,” of assorted quality. “‘I asked them where they were going to have the diamonds cut,’ Keller later testified in a London court, but of course they never intended to cut the stones. Some would go to San Francisco as further evidence of the richness of their find. Others would be planted in the concealed field for their investors to discover.” With their new goods secreted in luggage, the cousins made a beeline back to Canada.

Toward that summer’s end, and in response to a telegram, Harpending traveled to the San Joaquin Valley junction town of Lathrop, California, where he met a train steaming west toward San Francisco Bay. Among its passengers were a knackered-looking Arnold and Slack, who told him they’d been off working their claim, and had chanced upon even more gems there than they had anticipated—supposedly $2 million worth. Arnold went on to recount how they’d packed their spoils into a couple of buckskin sacks, but had lost one of those while rafting a treacherous swollen river. Fortunately, he said, the bag they rescued probably contained $1 million in stones, surely enough to confirm that their strike was a winner.

Tendering a receipt and taking charge of the bundle, Harpending carried it to his residence in the city to show partners Ralston, Roberts, Lent, and Dodge. “We did not waste time on ceremonies,” he recalled in his memoir. “A sheet was spread on my billiard table; I cut the elaborate fastenings of the sack and, taking hold of the lower corners, dumped the contents. It seemed like a dazzling, many-colored cataract of light.” Shaking off their excusable dumbfoundedness, those bigwigs decided they would sink no supplementary funds into this endeavor, until they took two more steps: recruit a skilled mining engineer to evaluate the elusive diamond lands, and take 10 percent of the pouch’s contents to New York City for appraisal by the most famous jeweler in America, Charles Lewis Tiffany. In addition, they decided to display some of the stones around San Francisco, hoping to stimulate buzz about the town’s latest wellspring of wealth and amplify expectations of future stock offerings.

As audacious as Philip Arnold and John Slack had been thus far, it’s hard to believe they weren’t worried their deception was suddenly in danger of being laid bare. Slack had by this stage collected the second $50,000 promised him, so he was prepared to get out anytime. Not so Arnold, who demonstrated “the intuition of a great poker player,” as writer Liebling put it: he wanted to see this con through.

* * *

Charles Lewis Tiffany (left) in his namesake store, around 1887.

Charles Lewis Tiffany (left) in his namesake store, around 1887.

It was almost a year after rumors of an “American Golconda” first reached San Francisco, that Harpending, Lent, and Dodge convened in Manhattan with an august body of other VIPs they presumed could advance their diamond-mining dreams. Those guests included General George B. McClellan, who’d led the Union Army and then run for president against Abraham Lincoln in 1864; Horace Greeley, editor of the influential New-York Tribune; and General Benjamin “Beast” Butler, who had commanded the harsh wartime occupation of New Orleans and was currently a venal U.S. representative from Massachusetts. (It would be part of Butler’s remit to propel legislation through Congress allowing any public lands contained in the diamond fields to be purchased for commercial use.) Also attending was Charles Tiffany, founder of the luxury retailer Tiffany and Company, who’d come to scrutinize the gems Arnold and Slack had brought back from their mysterious repository.

“Gentlemen,” Tiffany asserted, once he’d examined dozens of rough diamonds, rubies, emeralds, and sapphires, “these are beyond question precious stones of enormous value.” It took another two days for his lapidary to deliver a more precise estimate, contending the sparklers could, when cut, sell for a whopping $150,000. Extrapolating from that, Harpending hypothesized the full contents of the prospectors’ latest bag were worth $1.5 million!

One of the most gobsmacking aspects of this extraordinary tale, is how often Arnold and Slack benefited from inexpert analyses. Here again, luck was in their corner. Not until the full dimensions of this rip-off were revealed in the press, did Tiffany and his lapidary confess, abashedly, to having scant experience judging uncut stones. All that still stood in the way of Arnold’s big payday for devising his con job was to escort Harpending and a coterie of investment partners, plus Henry Janin, a Yale-educated mining engineer described as especially keen and scrupulous, on a last review of the bogus diamond site.

Emboldened by Tiffany’s inflated calculation, Arnold demanded the San Francisco magnates give him a $100,000 down-payment toward the eventual sale of his slice of the diamonds. He took that boodle and hied back to London, where he’s said to have secured an additional $8,500 in low-grade stones. While the winter snows of 1871 delayed Janin’s inspection of the diamond deposits, they didn’t stop Arnold and Slack from going out to re-salt their claim with these new rough gems.

Not until June 1872 did the chiseling cousins, together with Janin, Harpending, Lent, Dodge, and a Harpending ally named Alfred Rubery—none of them apparently sporting blindfolds this time—step off a train in the tiny south-central Wyoming town of Rawlins, bound for what most of them envisioned as the West’s next El Dorado. Once again, this party faced a multi-day serpentine horse trek, with Arnold frequently consulting his compass and looking lost, before finally reaching their goal. That turned out to be a sandy plateau in northwestern Colorado, east of the Green River Basin near the foot of a mountain currently called Diamond Peak, and on the border separating what remained the territories of Wyoming and Colorado—an expanse with geological similarities to South Africa’s diamond region. Straight away, the men grabbed picks and shovels and commenced their hunt for riches, with Arnold periodically suggesting where else they might look. “For more than an hour,” Harpending wrote in 1913, “diamonds were being found in profusion, together with occasional rubies, emeralds and sapphires. Why a few pearls weren’t thrown in for good luck I have never yet been able to tell. Probably it was an oversight.”

Days were spent exploring a two-acre range around the original claim (where the men easily gathered myriad stones, some embedded in anthills or perched incongruously atop rocky outcroppings), and then staking out an extra 3,000 acres, which would provide timber and water to the industry expected to grow there (but where no gems were located; it was assumed they must lie deeper underground). At the end of these exertions, Janin—who Liebling stated “had never in his life seen diamond land”—pronounced the site authentic…though his opinion may have been compromised by Tiffany’s exaggerated opinion of the sample stones, and he would’ve preferred more time to study the property. Janin went on to suggest that $1 million dollars worth of diamonds might conceivably be taken from the section every 30 days. Furthermore, he recommended that a proposed initial offering of 100,000 shares in the diamond-mining venture be valued at $40 apiece—even though Janin himself had earlier been invited to purchase 1,000 shares at $10 each. (When the engineer subsequently sold his shares at the greater price, netting $30,000, he became the only non-swindler to profit from this elaborate subterfuge.)

Henry Janin’s report on his inquiries convinced Ralston and his associates to establish the San Francisco and New York Mining and Commercial Company, which would be responsible for making the most of the West’s long-hidden diamond resources and, its directors imagined, was destined to move the world’s chief lapidary firms from Europe to California. It also led Philip Arnold to cash out of this humbug, while he could. He accepted $150,000 that had been pledged to him if Janin’s appraisal was satisfactory, and sold Harpending the balance of his interest in the gem fields for $300,000. With the $100,000 down-payment he’d previously received, that meant Arnold’s total take from this fleecing was $550,000—in excess of $13 million today! No wonder he and his family wasted no time in hightailing it out of town.

* * *

Amid all of this, Janin’s assessment had drawn the attention of Clarence King (right). A 30-year-old, Yale-educated scientist-explorer, he served as chief geologist with the famed Fortieth Parallel Survey, a U.S. government-sponsored undertaking charged with researching the rugged backcountry along America’s 40th parallel, from California to Wyoming. That fieldwork had taken King and his team straight through the region where they now believed Ralston’s diamond deposits rested. However, they hadn’t spotted so much as a pinch of diamond dust. Could they really have overlooked such an auspicious find? And if not, what other explanation was there?

Returning to northwestern Colorado during the bitter chill of November 1872, King’s company encountered little difficulty pinpointing the remote mesa Janin had marked off for future industrial development. While they, like so many of their predecessors, were briefly overwhelmed to find the site bestrewn with diamonds, sapphires, rubies, and emeralds, their scientific skepticism soon reasserted itself, and they noted the gems’ anomalous arrangement. “King noticed that whenever he found a diamond he would also find a dozen rubies,” Robert Wilson writes in The Explorer King, his 2006 biography of the survey’s head geologist. “Then his men realized that they weren’t finding stones at all except in places where the ground had been tampered with in some way.” Anthills had patently had rubies pushed into their sides with sticks, and places where diamonds should have been distributed well below the surface revealed nary a one.

King sped to San Francisco to inform Ralston’s investors that “the new diamond fields, upon which are based such large investment and such brilliant hope, are utterly valueless, and yourselves and your engineer, Mr. Henry Janin, the victims of an unparalleled fraud.” Henry Janin was embarrassed by these revelations, yet conceded their veracity. The diamond company’s principals took rather more persuading. One, in fact, asked King whether he would hold off a public announcement of his findings, at least until the duping could be confirmed. King wasn’t untalented at keeping secrets (indeed, in middle age he’d assume a double life, portraying himself as a light-skinned Black man and starting a family with an African-American nursemaid—truths concealed until after his demise). Yet in this instance, the geologist insisted, “There is not enough money in the Bank of California to make me delay publication a single hour.” Directors of the San Francisco and New York Mining and Commercial Company responded by dissolving their enterprise, and halting a planned public sale of 100,000 shares in the chimerical diamond diggings.

Newspapers promptly jumped on the story of how the West’s kings of commerce had been taken in by a couple of country cousins. The public, declared Carson City, Nevada’s New Daily Appeal on November 28, 1872, had been “hornswoggled by a very adroitly and expensively devised and executed salting process, whereby the very epidermis and bowels of the earth were made to bear false witness in favor of a deliberate and oddly planned masterpiece of roguery.” “The Sharpest Men in California Lose Nearly $2,000,000,” blared The New York Sun a week afterward (left). It’s said William Ralston alone squandered a quarter of a million dollars in this flimflam. William Lent claimed to have lost another $350,000. He went on to sue Philip Arnold for recompense, but ultimately settled out of court for a lesser sum.

While John Slack reportedly wound up as an undertaker in White Oaks, New Mexico, dying there in 1896, Arnold ended his life where it had begun, in Elizabethtown, Kentucky. He used part of his hoax spoils to buy a home, hundreds of acres of farmland, and horses to breed, but what became of most of the money is not known. In 1873 he followed Ralston’s example and set himself up in banking. But a dispute with a business rival five years later led to Arnold being wounded in a shootout, and dying from pneumonia after a few more months, on February 8, 1879. He was 49 years old.

One of the questions Arnold’s passing left unanswered was why, after abiding by the law for most of his life, he abruptly strayed into crime in San Francisco. Ron Elliott, the Kentucky author of 2012’s American El Dorado: The Great Diamond Hoax of 1872, recently offered some clues. “He was [in California] to witness first-hand the phenomena of the 1849 gold rush and learned of the greed in some men’s hearts,” said Elliott. “He also knew about the Comstock Lode and was around the diamond business. So, it’s not hard to imagine that he started thinking about creating the ‘next big thing’ as opposed to just waiting for it to happen. I think that was his initial motivation.

“Once he got the thing rolling, something else came into play. Asbury Harpending said that if Arnold had decided to go on the stage, he would have been the greatest actor of the 19th century. I consider myself pretty good at describing events, but I was at a total loss to write an account of how he managed to keep a straight face when Mr. Tiffany himself allowed that one-tenth of half of what he’d paid $20,000 for was worth $150,000! That leads me to believe that as events unfolded, Arnold was having the time of his life playing the part, I can see him smiling inwardly while saying, ‘Let’s just see if I can pull this off and how far I can push it.’ I am sure it was fun.”