America in the 1920s was stock-crazy, a nation of shopkeepers and sales reps hoping to become Rockefellers and Vanderbilts by moving fast on a hot stock tip. A generation earlier, small-time speculators had chased their dreams of wealth in poorly regulated “bucket shops,” which allowed people to bet on whether a stock was going to go up or down without actually purchasing any shares.

The federal government cracked down on the shops at the same time that a growing middle class began to invest in stocks, even though many investors had only the most rudimentary understanding of how the market worked. The number of Americans owning stock more than tripled in the first two decades of the twentieth century, prompting waves of feverish speculation and outright fraud.

By 1920, Denver’s maverick District Attorney Philip Van Cise had busted enough small stock market confidence games to know that they all followed the same script, with minor variations.

The con required a team of three men, though others might play supporting roles. The one who first befriends the mark is known as the roper or steerer. It’s his job to determine that the mark is a tourist, so as not to rile the police by going after locals. He then introduces the mark to the spieler, in a manner that makes the encounter seem coincidental. The spieler takes his two new friends to the stock exchange, where the exchange manager, known as the bookmaker, lays down the rules and takes the mark’s money. In situations where a shortage of manpower or props make it impossible to present a credible stock exchange, two grifters might attempt to manage the whole thing, without the mark ever setting foot inside the trading room; but that version, called playing against the wall, was much trickier to pull off.

The Payoff—so named because the mark is “paid off” with illusory winnings before he’s taken for good—was the most lucrative confidence game going. The Payoff, like other Big Con operations, was a twentieth century answer to a nineteenth-century problem. Short-con games, such as three-card monte or Jefferson Smith’s soap racket, required a certain amount of dexterity and hustle, but they were also quick. The main drawback was that you were dependent on the vagaries of street traffic—and sometimes, on the pliability of a passing cop.

Seeking more stability, enterprising grifters began to open stores that offered legitimate merchandise up front and a friendly card game or other swindle in the back room. Around 1870, legendary con artist Benjamin Marks opened a “dollar store” in Cheyenne, Wyoming, that lured in rubes with handy household items priced at a dollar each. Marks’ store is credited as the prototype, but the concept soon spread to many cities. Operators offered commissions to ropers to bring the suckers to their store and shelled out protection money to the police. A town that was well-fixed, so that the cons could be played with impunity, was known as the Big Store.

Popular as it was, the new business model had its limitations. Operating out of one location meant sacrificing mobility and anonymity; unhappy customers knew where to find you, even if the police weren’t interested. And, with few exceptions, the store was still a short-con enterprise. Revenues depended on the amount of cash the mark happened to have on him when he was lured into the store. How much better it would be, the thinking went, if you could play him for all he was worth?

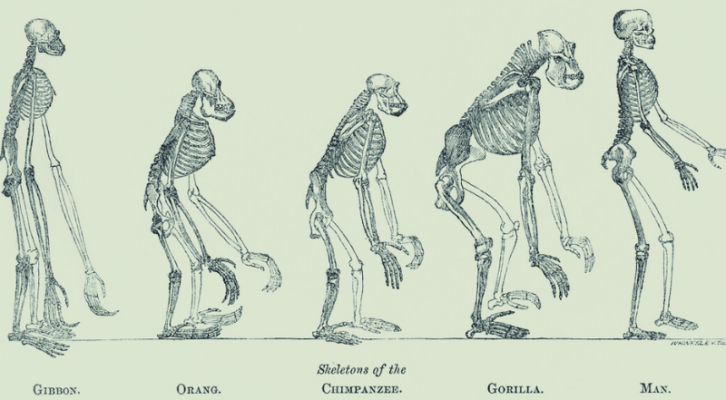

Thus began the evolution of the Big Con, which would replace the store with an entire world of make-believe—an elegant betting parlor, an exclusive private club, a busy stock exchange—that would unfold over a matter of days or weeks, leading the mark step by artful step to his doom. Between 1900 and 1920, increasingly elaborate versions of the Big Con emerged across the country, taking down five- and six-figure scores.

In one scenario, the mark is introduced to a fake telegraph office and a disgruntled Western Union employee who knows how to beat the system; all he needs is a confederate willing to place sure bets at a local bookie joint (also fake) while the telegraph operator delays releasing the race results. This arrangement and its mechanics show up prominently in The Sting.

Other Big Con scams involved a fixed horse race or a boxer or wrestler with deep personal reasons for wanting to strike back at his employers by throwing a match. (One racing scheme, popular in Denver for years, revolved around a can’t-lose racehorse named Dineen; there was no such horse.) Each operation was different, requiring a troupe of highly skilled performers, specializing in their respective roles but also able to improvise at a moment’s notice. Yet each one was built on the same basic ingredients: A roper locates a mark and determines, through casual conversation, that he has the resources to justify reeling him in. The spieler takes the mark into his confidence, explaining a surefire scheme to make money—telling the tale, as the grifters put it. The mark is allowed to win some money (the convincer). Sufficiently motivated, he is then put on the send for all the money he can raise. At the last moment something goes wrong, the money is lost (taking off the touch), and a physical altercation or other looming drama hurries the sucker out the door—and preferably out of town (the blowoff).

The Big Con was more discreet; all it took was the mark’s life savings.

Van Cise didn’t believe in perfect crimes, but he had to admire the efficiency of what Denver’s biggest con man, Lou Blonger had built in Denver. Dubbed The Fixer, Blonger had spun a web of graft and corruption for years and it spanned the city, from the courts to the jails to the mayor’s office. Top confidence men from all over the country came every summer to Denver’s Big Store.

Blonger and his right-hand man, Adolph Duff, got a cut from every touch— how much, Van Cise would learn, amounted to hundreds of thousands of dollars a year. If the game was played right, the sucker never realized that his money was at risk until it was gone. If the mark went to the police, the investigation would fail to locate any of the perpetrators, since the cops were part of the blowoff. Even if the complainant insisted on leading officers to the stock exchange, the place would be cleaned out before they arrived. And many of them were too mortified to report the loss. Confidence men counted on the stigma of being a mark to keep their victims from making a fuss. As they saw it, suckers deserved scorn, not sympathy. They had tried to get something for nothing and had instead been taught a valuable lesson.

_______________