Two months after my father died, in September 2002, my son, Davis, was born.

I started a college fund for Davis that week. I wasn’t going to put him through what I’d gone through to pay for college, working a full-time job yet still graduating with huge amounts of debt. I didn’t want him to be unable to go out for pizza because he was broke. And I wanted him to be free to pursue a career as an artist (or anything he wanted) without having to worry about how he would pay his rent.

By this point the ruse was providing a powerful stream of revenue. From 2002 to 2008, my annual income increased rapidly—from $204,000 to $352,000 to $498,000 to $916,000 to well over $1 million to, eventually, nearly $2 million. Clients were so desperate for the non-public intelligence we provided that they kept offering more and more money.

With a college fund to feed, a mortgage to pay, and my dream of making a real living as an actor a thing of the past, it was a relief to be earning more money than I ever dreamed rusing would bring in. Of course, I needed something to worry about, and my mind latched on to the fate of my high school classmate Valerie Plame, the CIA agent who was involuntarily retired after operatives in the George W. Bush administration outed her as a CIA spy to get back at her husband in 2003. The.way I saw it, two spies had graduated from the same Philly high school together, and when her story made headlines, it hit close to home.

Too close.

A major difference between her and me, of course, was that Valerie was patriotically spying for her country, whereas I was illegally stealing secrets to provide myself and my family a better lifestyle. If her career and personal life could be upended so thoroughly, what the hell would happen to me if I got caught? At a minimum there would be no more money. More likely, I’d go to jail for a significant portion of the rest of my life. Valerie did get the satisfaction of publishing a bestselling memoir, Fair Game, in 2007, but I was under deep cover.

The same year Valerie got exposed, 2003, LinkedIn was invented, though the employment-oriented service would not take off until after the crash of 2008. In 2006, LinkedIn had five million users. By 2009, fifty million. (Today, it’s half a billion.) The developers of LinkedIn recognized that there was huge money to be made if corporations had a central source for locating talent, but before then hiring RK Research was (nearly) the only way to go. For global executive search firms such as Korn Ferry (the largest search firm in the world as well as a publicly traded company), Russell Reynolds Associates, Spencer Stuart, and many others, I was LinkedIn.

Once, I turned down a new client because we didn’t have time to handle the project.

“Suppose I pay you double,” he said. I was confused. “Double what?” “Your fee.”

“Uh, wow, look, I’d like to but —”

“I’ll FedEx you a check for the entire project in advance.” The next morning there was a check for $80,000 at my door. I took the project.

There was such demand for top Wall Street talent that multiple clients often tasked us with extracting the exact same research, enabling me to make double or even triple for one job. It had never occurred to me that I could make this kind of money. My father wouldn’t have been surprised.

He always said I would make millions. It just wasn’t in the field I had been hoping for. In a way, it put me in the same league as the Wall Street executives I was helping shuffle around the board, even though they were making exponentially more.

Over the years, the hottest sectors to research were those that were booming usually because of political maneuvering. When I started for Leona in the late 1980s we researched defense industry titans like Lockheed and TRW because President Reagan had increased military spending.

In 2005, we started getting a ton of work in the financial derivatives space. I didn’t even know what a derivative was, not that it mattered. All I needed were a few buzzwords to throw around to establish credibility and to ensure that I was researching the right area.

And the derivatives groups inside the Wall Street firms weren’t hard to find.

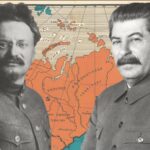

They were the ones locked down so tight that getting information out of them was nearly impossible. Most infamous were the collateralized debt obligation (CDO) groups. Lenders were making loans of question- able quality to American homeowners, then Wall Street was packaging these loans into bonds, repackaging the bonds into CDOs, selling them to investors around the world, but often holding on to some of them for their own portfolios. They were also selling insurance on these CDOs, called credit default swaps (CDS). Names for the top people in CDS groups were the second most requested for me to research. Many of the names during these years ended up as main characters in Michael Lewis’s bestselling 2010 book, The Big Short: Inside the Doomsday Machine. Lewis himself would’ve been on my research back in the early Leona days when he was an analyst at Salomon Brothers, an experience that inspired the book that made him famous, Liar’s Poker. Not that we cared about junior analysts like him. They were the inevitable detritus obtained as we trawled for directors and managing directors, the big fish of Wall Street. Greg Lippmann of Deutsche Bank, whom Lewis describes as “Patient Zero,” the individual most responsible for recognizing the impending collapse of the subprime housing market, was on my research dozens of times. (Ryan Gosling’s character in the Big Short movie, Jared Vennett, is based on Lippmann.) Morgan Stanley bond trader Howard Hubler, along with an eight-person team, made his firm $1 billion in 2006. My research has every one of those eight names. How much was it worth for Morgan Stanley’s competitors to know those names?

A significant fraction of $1 billion.

But getting them was a major challenge. Many times when calling Lippmann, Hubler, and others in the CDO and CDS groups, the individual on the other end of the phone would laugh out loud at whatever ploy I was using and hang up without even bothering to tell me I wasn’t who I said I was.

I began to worry that doing the job might no longer be possible. Already firms were using caller ID to identify outside calls. I could block caller ID, but then my number would come up as anonymous. Over and over, I was grilled. If I was a real person inside the firm, why was I calling from an anonymous number? For a while, I skirted the issue by getting transferred from an internal number to the area I desired. But firms caught on and eliminated that flaw in their system. I was increasingly stumped and frustrated.

Thank God for the intranet.

As the internet developed, so did company’s internal directories, which they called their intranet. Increasingly, firms digitized their organizational charts and put them on their intranet. I discovered that as long as an individual had access to this internal treasure trove, which most employees did, they could tell me anything I wanted to know. Many of these firms had become enormous over the years as they snatched up smaller firms via leveraged buyouts or other M&A strategies. The beau- tiful thing was, as these firms grew, expanding until they had offices all over the country and the world, all it took was finding one person willing to access the intranet and tell me what I wanted to know. They could be anywhere. They often were.

This didn’t solve the issue of my number showing up as an outside call. I needed to develop a ploy that would account for this. I needed a reason that an executive would be off-site and yet need critical information from the firm’s intranet. Who would need such information? Why would they be off-site? Where would they be?

Leave it to the US government to solve all of my problems.

$ $ $

As the stock market rose and Wall Street, due to its sheer size, posed a bigger risk to the overall economy, there was a corresponding growth of financial institutions’ compliance departments. Regulations had been put in place by an alphabet soup of governmental agencies — SEC, FDIC, FINRA — that firms were required to follow or suffer significant penalties, not to mention bad press. Compliance departments were housed within firms’ legal groups under the auspices of their top-dog lawyer, the general counsel. I decided to try a new approach.

“Hey, it’s Tom O’Brien in Compliance,” I began when a male assistant answered my call. Even though I was now exclusively using real names, I still tried to find Irish ones. Most times I’d get some sort of pleasantry back. I hadn’t asked for anything, so the person on the other end had no reason to be suspicious—yet.

“Hi, Tom, how’s it going?”

“How good could it be? I’m off-site in Washington, meeting with the US regulators. When they say jump, I say how high.” I manufactured a laugh.

If I got one back, I knew I was in good shape. But this time I got silence.

“How can I help you?” The assistant was all business.

“I’m filling out some compliance docs, and I need to list your boss on one. I just need his exact current title and we’re done.”

“Why don’t you look it up on our system?” he said. I could practically hear him sneering.

“Because I’m off-site, at the regulators’ office.” “Which regulators?”

“Seems like all of them are here breathing down our necks. Good thing we only have to do this once every three years.” I wanted to give the guy incentive to answer my questions, since he theoretically wouldn’t have to hear from me again for years.

“He’s the EVP of Fixed Income Trading,” the assistant said, finally giving me the title. The guy was difficult, but he hadn’t busted me or hung up, so I persevered.

“Perfect. That’s what we had, but it never hurts to be sure in Compliance.” I forced another laugh and still got nothing in return. “Oh, one last thing. I need to list his direct reports and we’re finished.”

“All of them?”The assistant acted as if the list was pages and pages long when, on average, most executives had between five and fifteen reports. “Well, the seven or eight or so who report directly to him. For these, I don’t need titles.” I tried to make it easy for the assistant, who was becoming more truculent as the call went on.

“I’m not supposed to be giving this information over the phone,” he said. “I looked you up, but as a Compliance person you should know that.” As we talked, I searched online for the name of the firm’s global head of fixed income. It was highly likely the EVP whose teams I was hunting

reported to that global head. I found the information just in time. “Hey, I’m the one who wrote those rules. But when Olivier de Laurier

says jump, I say how high.” I knew I was repeating the same line I’d used earlier, but I was trying to sell him on the we’re-in-this-together concept, that heads of Compliance, just like lowly assistants, gotta serve some- body, too.

“You work for Mr. de Laurier? I thought you said you were in Compliance.”

“I am, but these docs are for Mr. de Laurier.” I’d guessed right, so I pushed back. If I was from Compliance, the assistant had no choice but to help me. By knowing the name of the global head — the boss of the assistant’s boss — I’d established credibility as a “trusted employee.” I’d also put him in the difficult position of potentially getting his boss in trouble for not helping me.

“Can I email you the list?” The assistant still wasn’t completely sure about me.

“Normally, I’d say yes, but anything I receive while I’m at the regulators I’m required by law to declare. We only want to give them what they’ve asked us for. Also, I’m inputting the list directly into their system. Let’s just zip through this, and we’ll be done.”

“I’m not even sure it’s up to date,” he said, continuing to waffle. The call was like pulling teeth. He was doubting everything I said, but he continued to play ball.

“That’s okay. The final doc comes to your boss for confirmation. He literally has to sign his name at the bottom.”

The assistant read the list, though he hesitated after every other name. When he reached the end, I said, “All we need now are the titles and we’re done.”

“You said you didn’t need titles.”

“Whenever anyone is an SVP or higher, the form requires their title. Since your boss is an EVP, I’m assuming he has SVPs reporting to him.” I paused. From the assistant’s silence I knew I was right. After all, I was an expert in reporting structures. “Not having titles on a compliance document is like going out in the rain with no shoes on,” I added with a chuckle.

The assistant gave me the titles, which included the heads of the CDO and CDS groups. Booyah! I suspected that as soon as we got off the phone he would call around and discover I wasn’t with the company, let alone the compliance department. He was the type of person who normally would have shut me down right away. Yet he’d still given me everything I wanted. Why?

Because I was in Compliance.

As I was to learn, individuals working in Compliance were feared by others within the firm. This made even surly assistants hesitant to take a stand. No one wanted to be on the bad side of Compliance, the corpora- tion’s version of Orwell’s Thought Police. This put me in a strategically powerful position. The flip side was that because almost all compliance officers were lawyers from top schools — Harvard, Columbia, Penn — they were exactly the types that could, and would, come after me. Before these super lawyers had moved to Wall Street to make the big money, most had worked in the public sector doing fraud enforcement for the SEC or the Federal Reserve or some other regulatory or legal entity. Now that I was actively impersonating them, they had more than enough incentive, both professional and personal, to bust my ass. They also had the know-how and resources to track me down. Departments with names like Insider Threat Protection, Surveillance Unit, and Financial Crimes Compliance scared the hell out of me. These groups—and many others—were designed to stop people like me from doing exactly what I was doing.

But it was a perpetually tempting gamble. During this time I went so far as to impersonate the CEOs and COOs of some of Wall Street’s largest firms. Many of the men I pretended to be were regular talking heads on CNBC, Fox Business, and other news channels. Some were even on presidential commissions and advisory committees. I studied their inflections and the timbre of their voices. None of the men had accents, which was fortunate for me. Indeed, they all pretty much sounded (and looked) the same. Risky as it was, their elevated public status was why I chose them. If people believed I was this person, there was nothing they wouldn’t tell me. Indeed, most were blown away that they had the CEO on the phone, like they’d been gifted a rare audience with the king. They fawned, they flattered, they gave it up. More times than I can remember they’d say, “I can’t believe I’m actually talking to you.” And I wanted to respond: You’re not.

“Hey, one last thing,” I said to the assistant. “I need the traders in the CDO and CDS groups.”

I heard him groan, but even he knew it was too late to stop now. Just as I knew, doubts be damned, the same was true of me. Because the compliance ploy turned out to be my most successful ruse ever. I shared it with Pax and Shen, and soon all three of us used it exclusively. Indeed, the only thing that stopped the compliance ploy from working was the financial crisis of 2008, which demolished the economy. By the time the Great Recession was over, the American people had lost $9.8 trillion.

And this corporate spy saw it all coming.

______________________________________